colorado solar tax credit 2022

The Solar ITC can help to significantly reduce the total cost of a home solar system. However you may only be eligible for a 22 tax credit if you do that anytime between January 01 and December 31 2023.

The Table Contents Web Page From Sei Solar Home Design Online Course Online Courses Energy Conservation Free Energy

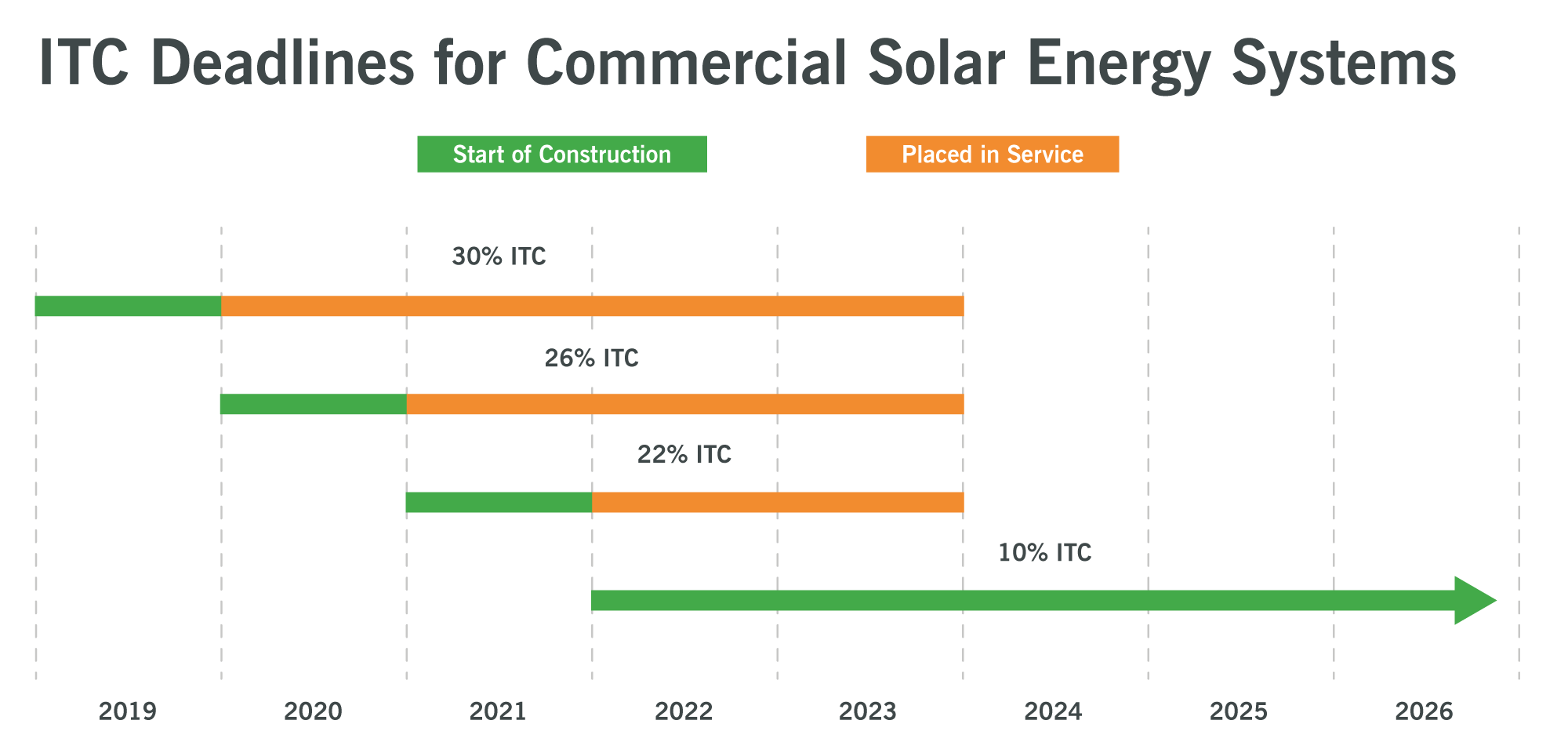

This means that all solar projects that begin construction in 2021 and 2022 will be able to receive a tax credit of 26.

. To be eligible systems had to be installed before January 1 2020. Xcel Energy offers the top utility net metering program in Colorado. These are the solar rebates and solar tax credits currently available in Colorado according to the Database of State Incentives for Renewable Energy website.

The federal solar tax credit. Net energy metering in Colorado. Cost of a Solar System.

Keep in mind that a tax credit works differently than a tax deduction. Audio recordings of committee hearings prior to 2022 are. Hopefully you are well on your way to receiving the 30 credit on your system when you file taxes.

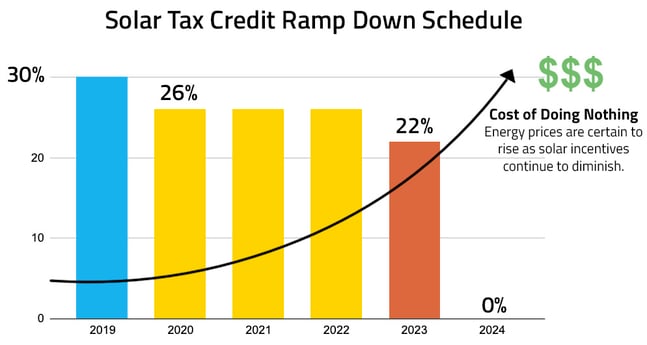

Colorado no longer offers state tax credits for solar energy systems. 2019 was the final year homeowners could take advantage of a 30 federal tax credit on residential solar power. It will then be phased out to 22 percent in 2023 and expire for homeowners in 2024.

To help more residents get started on solar energy Colorado offers considerable tax incentives and a solid net metering program. In 2023 it will drop to 22 and in 2024 to 10. Read User Reviews See Our 1 Pick.

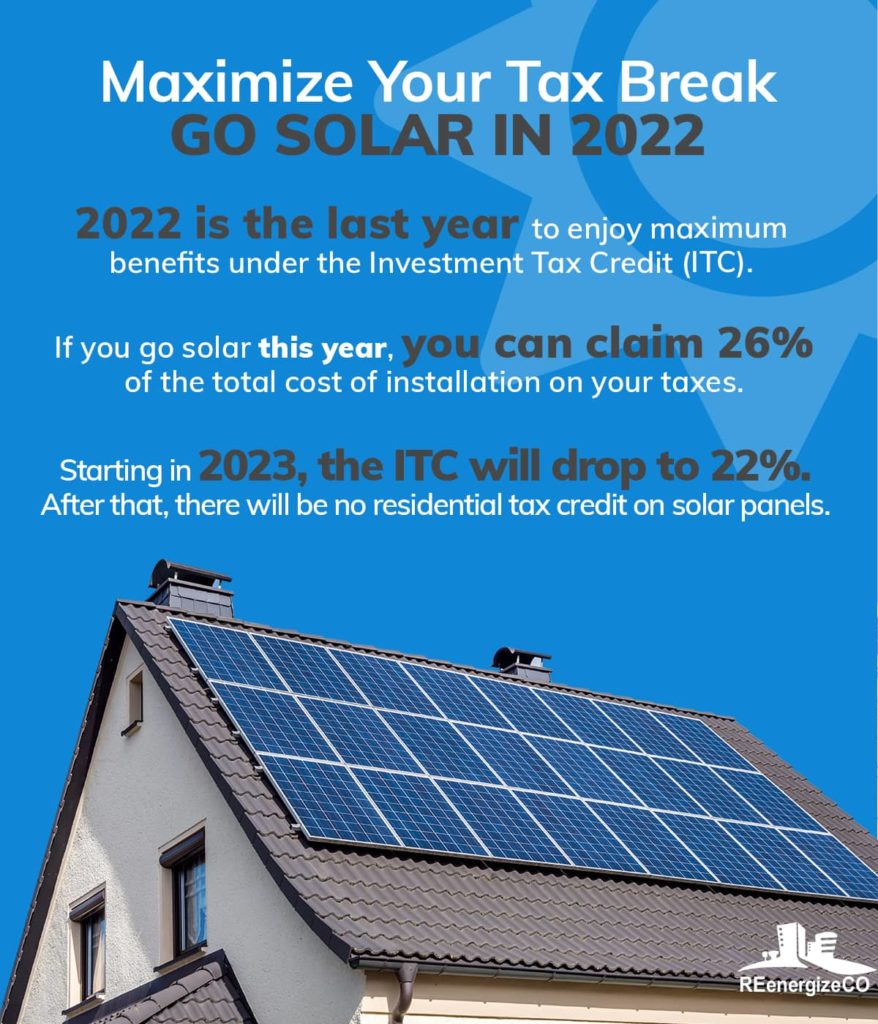

Colorado Utility or City Incentives. Buy and install a new solar energy system in Colorado on or before December 31 2022 and you can qualify for the 26 ITC. This is 251 per watt.

Solar Incentives in Colorado. However there is some variance in solar prices in different parts of the state. For more information on the cost of going solar in Colorado read on.

2022 is the last year for the full 26 credit. The graph below shows the average cost of installed solar systems in your. Solar Tax Credit Step Down Schedule.

The federal solar tax credit or investment tax credit itcrate will stay the same in 2022. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent. But cash in on the 26 percent credit soon since it is valid only till the end of 2022.

You can get these credits up to the 26 of our solar panel system worth. You do not need to login to Revenue Online to File a Return. All markets will drop to a 22 tax credit in 2023.

For US residents the ITC allows you to deduct 26 of the cost of your solar energy system from your federal taxes. Starting in 2023 the credit will drop to 22. Ad Determine The Right Solar Power Company For You.

After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online. If you use solar to heat your home or water heater instead of using electricity and gas then you can claim 26 percent of the solar system as. It holds steady at 30 through 2019 after which there is a gradual decrease until the credit ultimately reaches a cap at 10 in 2022.

1 With the average cost to go solar in Colorado hovering around 20175 the typical credit is 5246. The average cost of a solar panel system ranges between 15000 and 25000. Federal Solar Tax Credit ITC The federal tax credit is available statewide and provides a credit to your federal income tax in the amount of 26 of your total cost of going solar.

2022s Top Solar Power Companies. Colorado is one of the most popular states for solar conversions ranking 13th overall for solar adoption. The tax credit does not apply to solar water-heating property for swimming pools or hot tubs.

Another way to put it is that you will get 260 for every 1000 you spend on your residential solar panels. In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. The 26 federal tax credit is available for purchased home solar systems installed by December.

Colorado solar panels guide 2022. State tax expenditures include individual and corporate income tax credits deductions and exemptions and sales and use tax exemptions. The Federal Solar Tax Credit is 26 percent for projects that start construction before Dec.

Although 2019 was the last year the full 30 tax credit was available homeowners and businesses in Colorado City CO can still receive a 26 credit through 2022. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. With this price range in mind heres a breakdown of how much the 26 solar tax credit could help you save on a residential solar system.

You may use the Departments free e-file service Revenue Online to file your state income tax. Keep in mind that the ITC applies only to those who buy their PV system outright either with a cash purchase or solar loan and that. Dont forget about federal solar incentives.

Cost for an installed residential solar system in Colorado is currently 11122 after claiming the 26 federal solar tax credit. However with the average price of 20175 for solar panels or 14930 after the federal tax credit in the state many homeowners wonder if going solar will ultimately save them money and benefit them after installation. Read Our Company Breakdowns.

Immerse yourself in discussions of the latest industry trends emerging. The solar investment tax credit ITC which was scheduled to drop from 26 to 22 in 2021 will stay at 26 for two more years. So if you invested in solar power last year congratulations.

To maximize your ITC percentage be sure to act before the end of 2019. This memorandum provides an overview of the financial incentives for solar power offered by utilities in Colorado as well as other incentives. With built-in networking breaks and an exclusive reception for attendees this is your chance to connect with leading professionals within the renewable energy world.

Beginning in 2023 it will go down to 22 then ONLY commercial units in Colorado City will permanently receive a 10 credit thereafter. Save time and file online. This ITC will not last forever.

The solar energy systems that qualify for a 26 tax credit must be placed into service by December 31 2022. In 2022 the cost for a 5 kilowatt kW solar installation in Colorado is about 12000 after tax credits and about 17000 before tax credits. For instance if you purchase solar panels worth 15000 you can get a credit of 3900 on your federal taxes.

Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it. Colorado Solar Incentive. 22 for systems placed in service after 12312022 and before 01012024.

So as long as you install your solar panels prior to December 31 2022 youll enjoy a 26 tax credit when you file your federal taxes. The federal tax credit falls to 22 at the end of 2022. Join top deal makers from around the country in Denver Colorado for Novogradacs two-day conference.

However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax credit or rebate to a residential or commercial property owner who installs a renewable energy fixture on his or her residential or commercial property.

Is Solar Worth It In Colorado Colorado Solar Panels 2021 Solar Website

Is Solar Worth It In Colorado Colorado Solar Panels 2021 Solar Website

The Extended 26 Solar Tax Credit Critical Factors To Know

Solar Tax Credit Details H R Block

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

How Installing Solar Panels Can Help You Save On Your Taxes

Biden S Biggest Idea On Climate Change Is Remarkably Cheap The Atlantic

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Colorado Solar Incentives And Rebates 2022 Solar Metric

U S Low Income Solar Programs Incentives 2022 Ecowatch

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

Maryland Community Solar What You Need To Know Solar On Earth

Build Back Better Will Cut Cost Of Installing Rooftop Solar Panels By 30 White House Says Fox Business

Solar Tax Credit 2022 Incentives For Solar Panel Installations

What Tax Deductions Can I Claim For Installing Solar Panels In Colorado